THE CREATIVE RECESSION — PART II The Numbers Don’t Lie: How Output, Risk and Opportunity Have Collapsed in Film and TV

- Tim Pickett

- Jan 12

- 4 min read

Updated: Jan 13

In Part I, we named the problem: the Creative Recession — a period marked by shrinking ambition, fewer opportunities, and a growing sense of cultural stagnation across film and television.

In Part II, we look at the evidence.

Because this isn’t just a feeling.

It’s measurable.

Across film and TV, the data tells a consistent story: less is being made, fewer people are getting through the door and the work that survives is increasingly narrow in scope and risk.

1. Fewer Films Are Being Made — Especially Where It Matters Most

Despite the perception of endless content, global film production has declined, particularly in the space where originality historically thrived: the $1–15 million budget range.

What’s disappearing isn’t micro-budget cinema (which survives through sheer determination) or mega-budget studio films (which are protected by scale).

What’s disappearing is the middle — the proving ground.

That mid-budget space once produced:

New directors

Genre reinventions

Career-building films

Cultural touchstones that weren’t based on existing IP

Today:

Pre-sales have collapsed

MGs are rare

Financing without stars is near-impossible

The result is a dramatic drop in films that are designed to take creative risks but still reach real audiences.

This is one of the clearest indicators of a creative recession: when the industry stops investing in its own future talent pipeline.

2. TV Output Has Narrowed — Not Expanded

Streaming created the illusion of abundance. In reality, TV commissioning has become narrower, not broader.

Key shifts:

Fewer shows are greenlit overall

Fewer shows survive past season one

Limited series now dominate because they cap risk

Writer-led, long-running dramas have become rare

In earlier eras, shows were allowed to evolve:

Characters grew

Tone refined itself

Audience loyalty built gradually

Now, many series are expected to arrive fully formed and perform immediately — or be quietly abandoned.

This discourages experimentation and rewards formula.

A creative ecosystem can’t thrive when every idea is treated like a finished product rather than a work in progress.

3. Risk Has Compressed Into a Narrow Band

Across both film and TV, risk tolerance has collapsed inward.

A growing percentage of projects now fall into a small number of categories:

Sequels

Reboots

Remakes

Adaptations of existing IP

Algorithm-friendly genre hybrids

Original ideas haven’t vanished — but they’ve been pushed to the margins, often stripped of scale, marketing support or longevity.

This leads to:

Homogenous tone across genres

Predictable story structures

Familiar visual language

Repetitive thematic framing

When risk is eliminated upstream, sameness is inevitable downstream.

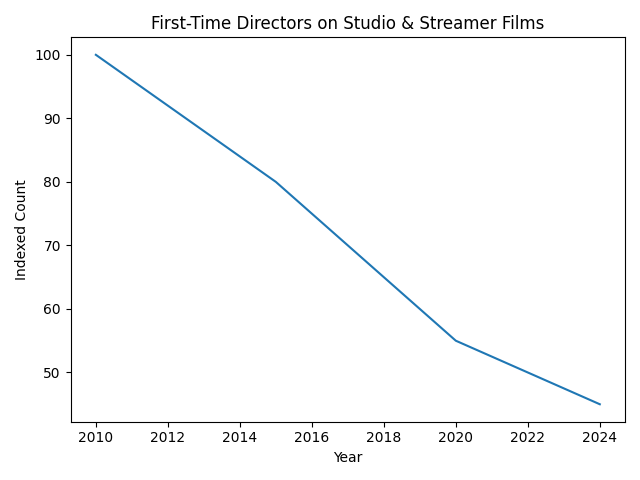

4. The Opportunity Gap Is Widening

One of the most damaging effects of the creative recession is who doesn’t get to participate.

There are fewer:

First-time directors making studio-backed films

Writers creating original TV series

Second- or third-time filmmakers getting larger budgets

Career-building “middle films”

The traditional ladder is broken.

Instead of progression:

Talent is either stuck at micro-budget level

Or expected to leap straight to premium scale

Most can’t — and shouldn’t have to.

Great careers are built through iteration, not miracles.

5. Fewer Projects = Higher Pressure = Safer Choices

As output declines, pressure per project increases.

When fewer films and shows are made:

Each one must “justify” itself more aggressively

Marketing expectations inflate

Internal fear increases

Decision-making becomes conservative

Ironically, this makes failure more likely, not less.

A single underperforming tentpole now carries enormous financial and reputational weight — whereas a slate of smaller projects spreads risk naturally.

This is the opposite of how innovation works in every other industry.

6. Cultural Impact Has Become Rare

Another measurable symptom of the creative recession: fewer shared cultural moments.

Fewer breakout films

Fewer shows people talk about week-to-week

Shorter cultural shelf life

Faster content churn

When output slows and risk narrows, culture fragments.

When culture fragments, audiences disengage.

This isn’t because audiences want less originality — it’s because they’re being offered less of it.

Cultural relevance thrives on volume, rhythm and risk — all three have been reduced.

What the Data Really Shows

Taken together, the evidence points to a single conclusion:

The industry hasn’t lost creativity.

It has lost confidence.

The creative recession is not caused by lack of talent, audience interest or global platforms.

It’s caused by:

Risk aversion

Consolidated power

Over-engineered decision-making

Fear of failure at scale

And fear, left unchecked, always produces contraction.

Where This Leaves Us

The data doesn’t suggest collapse.

It suggests correction is overdue.

The current system:

Produces fewer projects

Carries greater financial risk

Delivers diminishing cultural returns

That’s not sustainable.

Coming Next: PART III

Rebuilding the Ecosystem

How film and TV can:

Spread risk intelligently

Increase output without increasing cost

Restore opportunity

Turn creativity back into an asset, not a liability

Creative recessions don’t end by accident.

They end by design.

Sources & Further Reading

This article draws on aggregated industry reporting and long-term trend analysis from leading trade publications, market research firms, and industry bodies, including Variety, The Hollywood Reporter, Screen Daily, Deadline, BFI Statistical Yearbooks, WGA & DGA reports, Ampere Analysis and FX Research / John Landgraf (“Peak TV”).

These sources reflect consistent, long-term directional shifts in film and television production rather than isolated data points. While exact figures vary by territory and methodology, the underlying trends are widely reported across industry research and trade publications.

Selected Primary Sources

Independent Magazine — The Demise of Mid-Budget Cinema

Televisual — Major Streamers Cut Scripted TV Commissions

Ampere Analysis (via The Desk) — Scripted TV Orders Down 24% in H1 2025

Council of Europe Observatoire — TV Commissioning Slowdown in European Fiction

Business Insider — Scripted Orders Down vs Peak TV

British Film Institute (BFI) — Statistical Yearbooks 👉 https://www.bfi.org.uk/industry-data-insights/statistical-yearbook

Comments